Running a shop or business in Pakistan these days means you’ve probably heard people talk about the FBR POS system. You may have thought to yourself:

- What is this FBR POS system?

- Why is everyone saying it’s important?

- How do I get it set up in my own billing system?

- Is it expensive? Is it hard? Do I need to be tech-savvy?

No worries at all. This guide is written exactly for people like you who are doing business and just want a clear explanation in simple, plain words.

Let’s start from the beginning.

What Is the FBR POS System?

FBR stands for Federal Board of Revenue. It’s Pakistan’s government department that looks after taxes and financial matters.

Now the FBR has made it mandatory for certain registered businesses to connect their sales systems to FBR. This means when you sell something in your shop or business, the FBR should be able to see that sale in real time.

This is done using the FBR Integrated POS System.

So basically, your billing system or sales software will be connected with FBR and it will automatically send sale data to FBR every time you issue a receipt to a customer.

Why Is FBR Integration Important?

Here’s why the FBR POS integration matters:

- It keeps your business record clear and legal in the eyes of the government.

- It helps you avoid heavy penalties or legal issues, especially if your business is registered under Sales Tax.

- It shows transparency. FBR can see that you’re properly charging and submitting taxes.

- It increases trust. Your customers can check their receipts online through FBR’s system.

- It helps you claim input tax adjustments more easily (which helps you save money on your own business expenses).

So, if your business falls under FBR’s listed sectors, or if you’re planning to grow in the future, this is something you’ll eventually need anyway.

How to Integrate FBR POS with Your System

Let’s break it down step by step in simple language. Even if you’re not tech-savvy, this will help you understand what happens in the process.

Step 1: Generate Your POS ID

- Open a web browser and go to FBR Website: https://fbr.gov.pk/

- Log in with your user credentials.

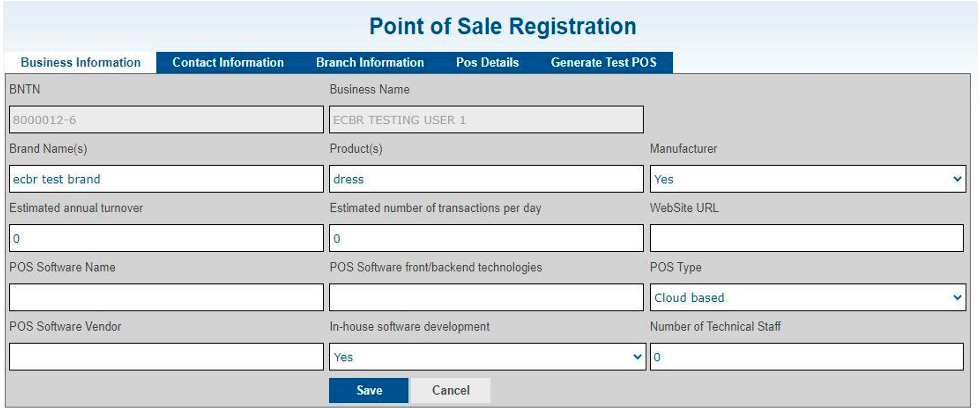

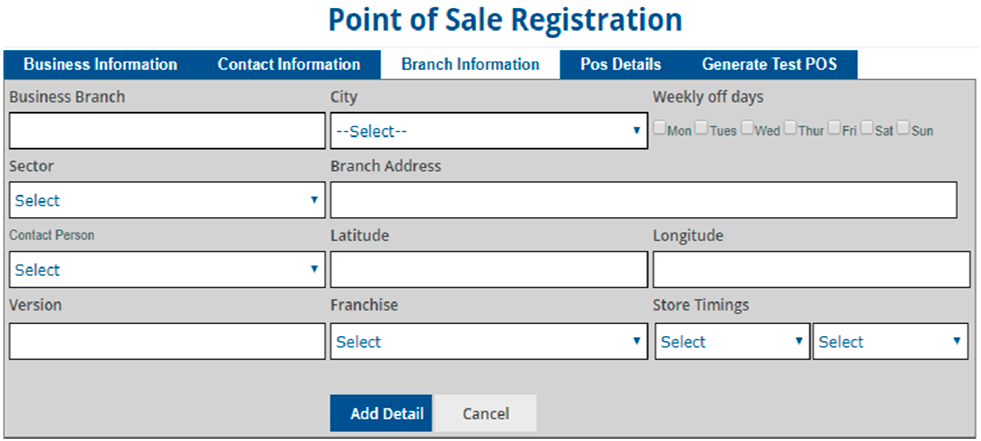

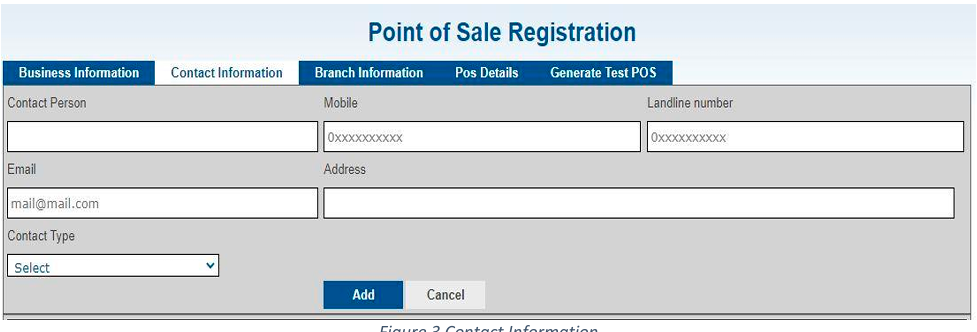

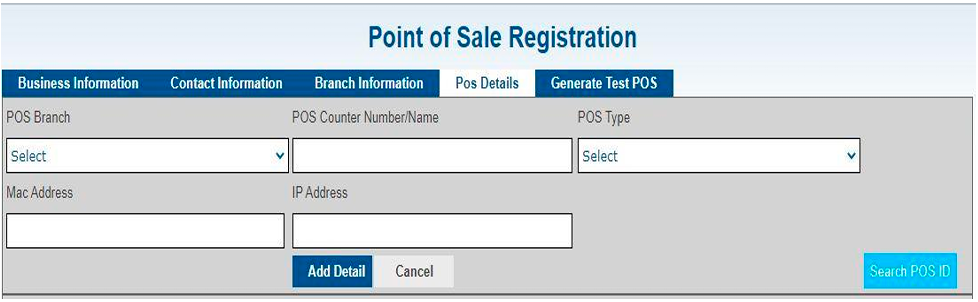

- Navigate to Registration → POS Client Registration.

- Complete all required fields for each business branch.

- Submit the registration form.

- On success, copy your POS Registration Number and keep it safe.

2. Install the FBR IMS Service

2.1 Download & Extract

- Extract contents into your chosen directory.

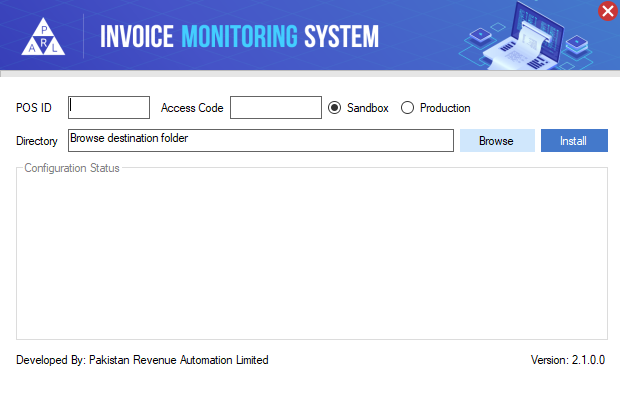

2.2 Run the Setup Wizard

- Double-click FBRIMS_Setup.exe in the extracted folder.

- Enter your POS ID and Access Code.

- Select Sandbox (testing) or Live.

- Choose installation path → Next → Install.

2.3 Verify Windows Service

- Press Win + R, type services.msc, Enter.

- Scroll to the Fiscalization Service under F.

- If listed, the service is active.

2.4 Manual Service Installation (if needed)

cd C:\Windows\Microsoft.NET\Framework\v4.0.30319

installutil.exe “C:\Path\To\FBRFiscalizationService.exe”

net start FBRFiscalizationService

2.5 Test the Service Endpoint

- Open your browser to: http://localhost:8524/api/IMSFiscal/get

- You should see “Service is responding.”

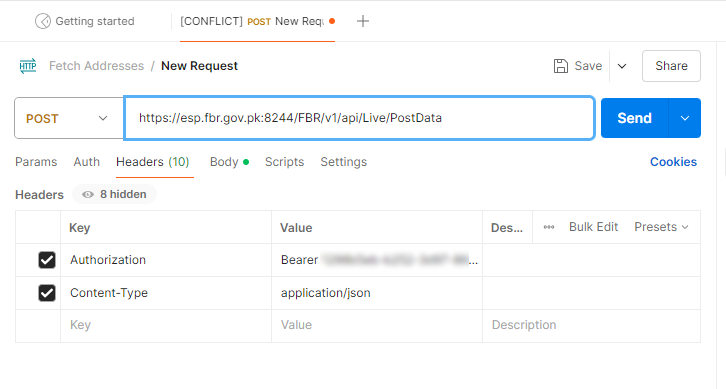

3. Integrate with Your POS Using Postman

3.1 Create a New Request

- Launch Postman (install if not installed).

- Click New → Request.

- Set Method to POST and URL to https://esp.fbr.gov.pk:8244/FBR/v1/api/Live/PostData.

- Token: xxxx-xxxxxxxx-xxxxxxxxxxxxx

3.2 Configure Headers

- Authentication: Bearer <Your-Token>

- Content-Type: application/json

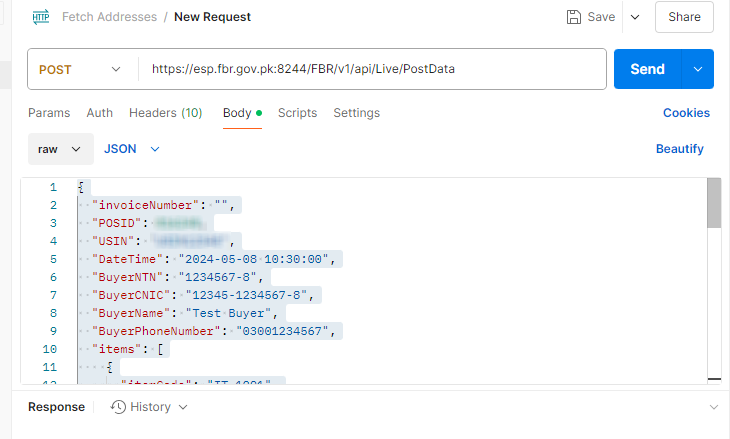

3.3 Add the JSON Body

{

“invoiceNumber”: “”,

“POSID”: 123456,

“USIN”: “1234567890”,

…

}

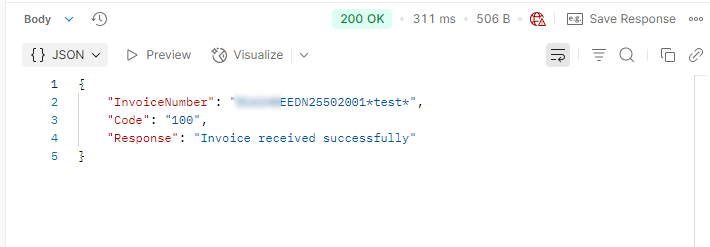

3.4 Send & Verify

- Click Send.

- Confirm you receive a new invoice number in the response.

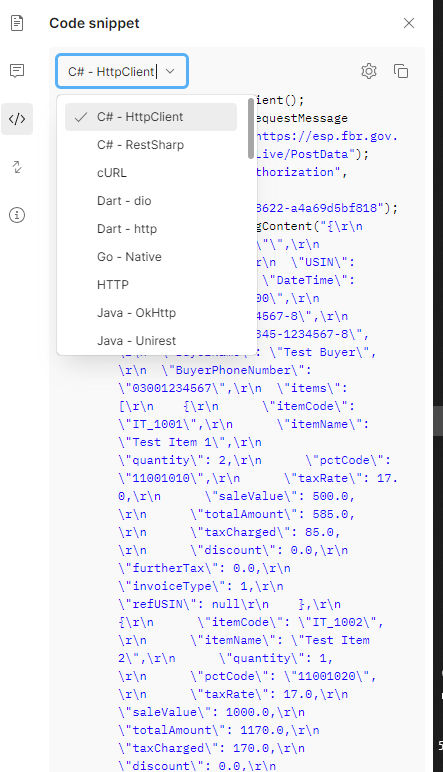

3.5 (Optional) Generate Snippet

- Click </> to get code for your framework (e.g., C# – HttpClient).

- Copy into your POS backend to automate fiscal calls.

All done! You have generated your POS ID, installed the IMS service, and integrated FBR fiscalization into your POS system.

Summary!

Step 1: First, Register Your Business with FBR

Step 2: Tell FBR That You’re Using a POS System

Step 3: Get the API Details from FBR

Step 4: Add the Batch ID in Your POS

Step 5: Test the System and Go Live

Need Help? Let Theta Solutions Handle It for You

FBR integration can feel like a complicated job, especially when APIs and technical setups are involved.

But that’s exactly what we do every day.

Our team at Theta Solutions has helped many businesses in Pakistan get FBR-integrated POS systems from small shops to big chains.

We handle everything for you from registration to going live. You just focus on your business — we’ll handle the tech side.

If you want to:

- Get a fully ready POS system with FBR integration

- Upgrade your current system

- Or connect your existing POS with FBR

Then just reach out to us. We’re happy to guide you and provide a free consultation. Just share your business details with us and we’ll suggest the best solution.

Final Thoughts

The FBR POS system is no longer something optional. It’s becoming a necessary part of running a legal, tax-compliant business in Pakistan.

Instead of waiting or getting confused, it’s better to set it up the right way with the right people.

So whether you’re just starting your retail shop, expanding to new branches, or already using a billing system this is the right time to go FBR integrated. Let Theta Solutions help you make that transition easy and worry-free.